The earliest and most well-known cryptocurrency is Bitcoin (BTC), a digital currency that is transmitted directly between users on a decentralized network known as a blockchain and functions without the need for a central bank. Because Bitcoin is regarded as both a speculative investment and an emerging form of digital money, its value in relation to the US dollar (USD) is one of the most keenly monitored financial indices worldwide.

In contrast to standard fiat currencies (such as USD or EUR), Bitcoin lacks a government-set official exchange rate. Rather, supply and demand on several cryptocurrency exchanges, including Coinbase, Binance, Kraken, and others, decide the market price. Based on investor activity, news, worldwide economic trends, and general financial market mood, the price fluctuates frequently, sometimes by hundreds or thousands of dollars in a single day.

Current Bitcoin Market Value (USD)

One Bitcoin is currently worth $89,509 USD.

This implies that, before fees or conversion costs, you would get about that amount if you were to sell a single Bitcoin on the open market and convert it to US dollars. This value is a current figure that changes in response to trade activity.

Similar numbers can be found in data from major cryptocurrency price aggregators: according to numerous sources, Bitcoin is trading between $89,500 and $90,000, depending on the platform and most recent trades.

Why Bitcoin Prices Are Highly Volatile

When compared to more conventional assets like equities or fiat money, the price of bitcoin is very erratic. Several things affect whether the price increases or decreases:

1. Factors Influencing Bitcoin Price Fluctuations

The price of Bitcoin increases when more people want to purchase it; it decreases when more people want to sell it. While anxiety and uncertainty can cause sell-offs, large institutional investments or public endorsements can raise prices.

2. Macroeconomic Factors Influencing Bitcoin Prices

Bitcoin prices may be impacted by things like inflation statistics, central bank interest rate choices, or geopolitical unrest. As investors respond to more general economic news, Bitcoin has fluctuated around the $90,000 mark in recent weeks.

3. Historical Volatility in Bitcoin Prices

Historical events, like Bitcoin’s brief exceedance of $100,000 in the past, show how quickly prices may rise or fall depending on market factors and investor activity.

4. How Regulatory Decisions Influence Market Prices

Price can be significantly impacted by government regulation choices. The market frequently reacts quickly to announcements on institutional access, taxation, or cryptocurrency regulations.

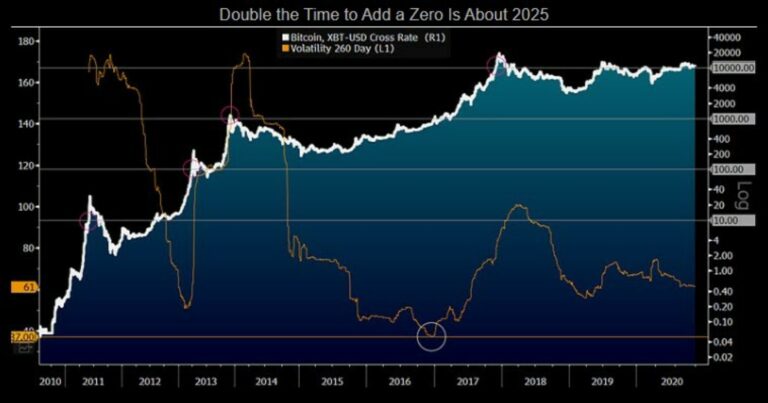

Bitcoin: From Near-Zero Value to Extreme Fluctuations

In 2009, the value of Bitcoin was practically zero. It saw enormous growth stages, volatility spikes, and many record highs throughout the course of the following ten years. Bitcoin even reached a high price of over $125,000 in 2025, but it later dropped to its current levels.

This history demonstrates that Bitcoin is a high-risk and high-reward asset since its value can fluctuate significantly in a short amount of time.

Bitcoin Price Tracking: What You Should Keep in Mind

If you are considering purchasing or monitoring the price of Bitcoin:

For up-to-date information, use trustworthy price trackers like CoinMarketCap or CoinGecko.

When converting Bitcoin to USD, be mindful of exchange fees and spreads.

Recognize that the USD price is always fluctuating due to market activities.

Final thoughts

The article provides a clear and accessible overview of Bitcoin, explaining its decentralized nature, market-driven value, and significant volatility. It effectively outlines factors influencing price fluctuations, including investor demand, macroeconomic trends, regulatory decisions, and historical events, while highlighting Bitcoin’s growth from near-zero to high-value highs. Practical advice on using reliable price trackers and accounting for fees adds value for readers. However, some figures, like the $125,000 peak in 2025, may be inaccurate, and the article could better emphasize unique risks like security and scams. Overall, it serves as a solid primer for understanding Bitcoin as a high-risk, high-reward asset, though cross-checking real-time data is essential for accuracy.